DEX-to-CEX ratio hits new high as crypto traders flee centralization

Cointelegraph

2025-07-17 21:46:27

Cryptocurrency traders have been moving away from centralized exchanges (CEXs) in favor of decentralized exchanges (DEXs), pushing the CEX-to-DEX ratio to a new all-time high.

Spot trading volume on DEXs surged at least 25% in the second quarter of 2025 over the previous quarter, while CEXs volumes plunged almost 28%, according to the latest quarterly industry report by the crypto data aggregator CoinGecko.

This shift drove the DEX-to-CEX ratio to a record high in Q2, rising from 0.13 in the previous quarter to 0.23, the report noted.

Despite the increasing ratio, the spot DEX market is still significantly smaller than CEX, with the top 10 decentralized trading platforms posting $877 billion in volume in Q2, compared with $3.9 trillion on CEXs.

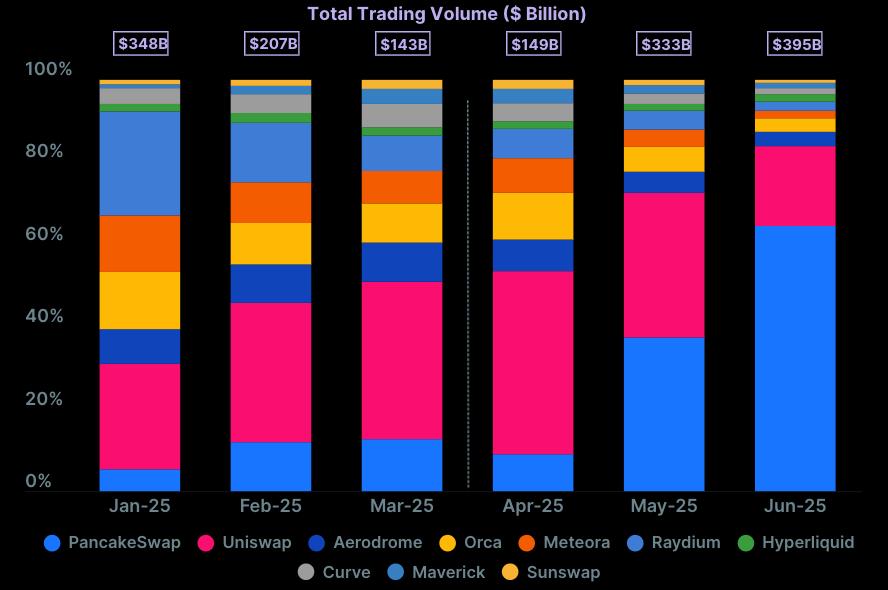

PancakeSwap and BSC lead DEX momentum

PancakeSwap, a DEX built on the Binance Smart Chain (BSC), was the biggest gainer, with volume growing 539% to $392.6 billion in Q2 from $61.4 billion in Q1.

With the massive surge, PancakeSwap has emerged as the largest DEX globally, accounting for 45% of all trades in Q2, the report said.

According to CoinGecko, the DEX surge in Q2 can be attributed to the launch of Binance Alpha in May, which routes trades through PancakeSwap.

“In turn, this has also made BSC the most popular chain for DEX trading, overtaking the likes of Ethereum, Base and Solana,” the report noted.

Perpetual trading volume prints high on DEXs

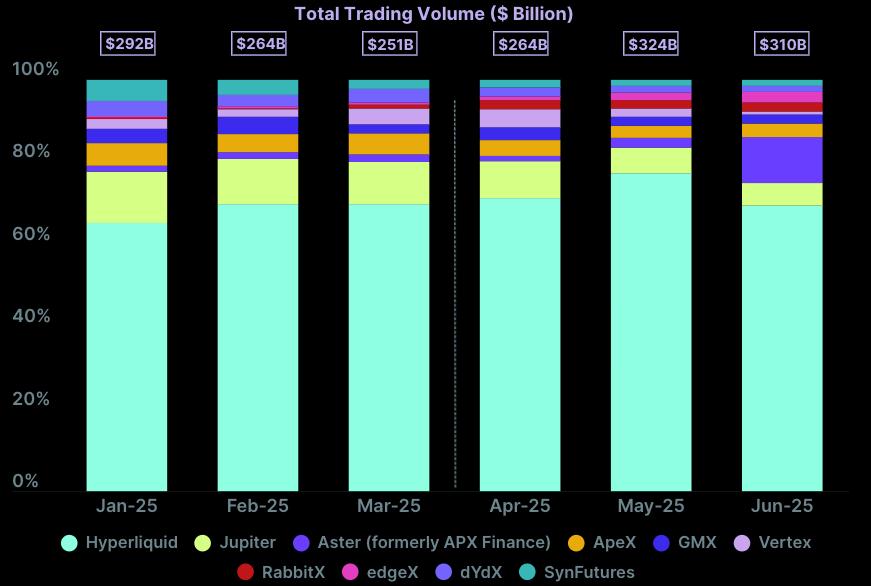

Apart from increasing spot trading volumes, decentralized crypto trading has also reached a major milestone in terms of perpetual futures (perp) trading, where traders speculate on the price movements without owning assets.

According to CoinGecko data, perp trading volume on DEXs hit a new all-time high in Q2, reaching a $898 billion mark for the first time in history.

In perp markets, Hyperliquid — a decentralized perpetual exchange (perp DEX) built on its own layer 1 blockchain — continued to increase its dominance, recording a $653 billion trading volume with a 73% market share.

Within the top 10 perp DEXs, only Hyperliquid, Aster (formerly APX Finance), RabbitX and EdgeX posted volume growth.

On the other hand, dYdX, once a popular perp DEX, continued to see its volume plummet, recording $5.3 billion in average monthly volume, compared to more than $10 billion in January 2025.

While derivatives continued to print new highs on DEXs in Q2, the market performed somewhat weaker on centralized alternatives, with CEXs seeing a slight 3.6% dip in derivatives trading quarter-over-quarter, according to data from TokenInsight.

Tin tức mới nhất

BitouChnews

2025-07-17 15:43:08

BitouChnews

2025-07-10 04:01:32

BitouChnews

2025-07-10 04:00:25