Bitcoin Price Analysis and Prediction: Key Targets for This Week

Coinpedia

2025-08-05 06:14:51

Bitcoin has attempted to regain midterm bullish sentiment after rebounding from the crucial targets on Monday, August 4, 2025. The BTC/USDT pair rebounded nearly 1 percent from the 50-day Moving Simple Average (SMA) to trade around $114,981 during the mid-New York session.

The wider crypto bullish rebound today was bolstered by the rising interest in artificial intelligence (AI), which helped U.S. stocks add over $1 trillion in market cap. Additionally, Bitcoin’s Funding Rate has remained positive for more days since mid-July 2025.

On-chain Data Shows Whale Investors Are Buying Retail Doubt and Fears

As Coinpedia reported, a series of re-awakenings by Satoshi-era whales has dramatically increased retail traders’ midterm fear amid long-term bullish crypto sentiment. Nonetheless, on-chain data shows whale investors, led by Bitcoin-treasury entities, have remained convinced of BTC’s ability to hedge against inflation and market uncertainty.

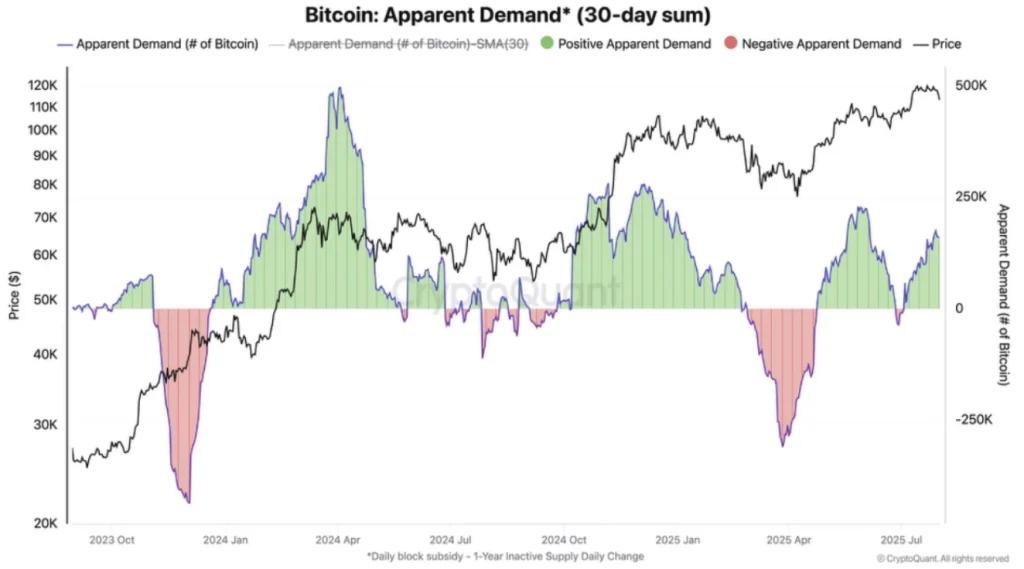

According to market aggregate data from Bitcointreasuries, the number of BTC-treasury entities increased by 23 in the past 30 days, thus their holdings rose by 4.4% in the same period to hover around 3.64 million. On-chain data analysis provided by CryptoQuant shows Bitcoin’s demand remains intact, especially after accumulating around 160k BTCs in the past 30 days.

Key Midterm Targets for BTC/USDT

Bitcoin price has been trapped in a falling logarithmic trend since hitting its all-time high (ATH) around $122,296 on July 14, 2025. The midterm volatility is well-primed to heat up later this week amid high-impact news from the Bank of England (BOE), which is expected to cut its interest rate to 4 percent from 4.25 percent on Thursday.

In the four-hour timeframe, the BTC/USD pair rebounded from the lower border in the past 24 hours. A consistent close above $115k should trigger a midterm rally towards $117.8k. However, it is prudent to consider a potential retest of $112k before a rally towards ATH soon.

Tin tức mới nhất

BitouChnews

2025-07-17 15:43:08

BitouChnews

2025-07-10 04:01:32

BitouChnews

2025-07-10 04:00:25