Japan proposes reclassifying crypto, paving way for ETFs and lower taxes

Cointelegraph

2025-06-24 19:54:48

Japan’s Financial Services Agency (FSA) has proposed a sweeping reclassification of cryptocurrencies that could clear the path for the launch of crypto exchange-traded funds (ETFs) and introduce a flat 20% tax on digital asset income.

The proposal, introduced on Tuesday, suggests recognizing crypto as “financial products” under the scope of the Financial Instruments and Exchange Act (FIEA), the same regulatory framework that governs securities and traditional financial products.

The proposed reclassification could also shift Japan’s current progressive tax system, which taxes crypto gains at rates up to 55%, to a uniform 20%, mirroring the treatment of stocks. That change could make crypto investing more attractive to both retail and institutional players.

The proposed shift is part of the Japanese government’s broader “New Capitalism” strategy, which seeks to position the country as an investment-led economy.

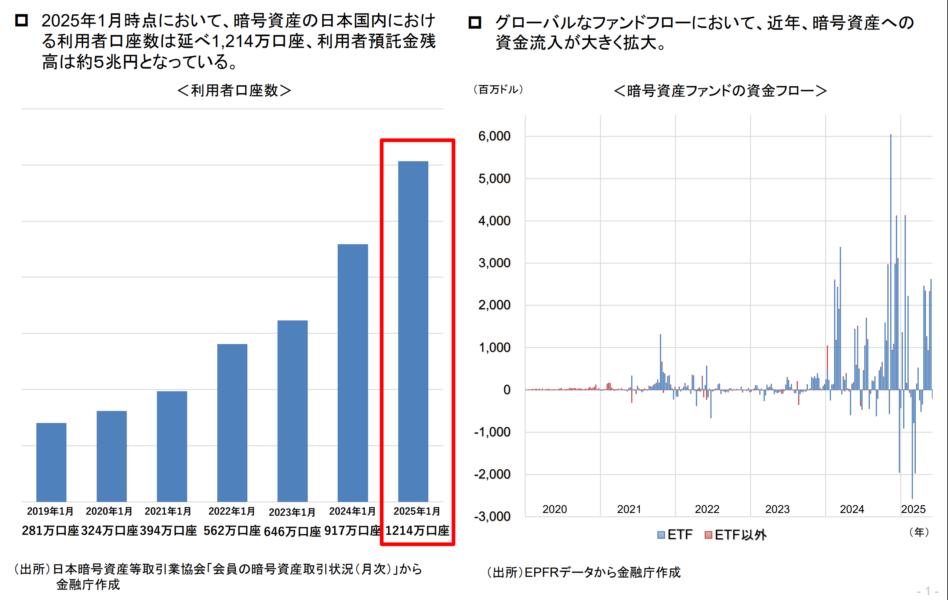

Japan surpasses 12 million active crypto accounts

The move comes amid growing interest in crypto as a legitimate investment asset. According to the FSA, more than 12 million domestic crypto accounts were active as of January 2025, with assets held on platforms exceeding 5 trillion Japanese yen (roughly $34 billion).

In the proposal, the FAS also revealed that crypto ownership now surpasses participation in some traditional financial products, such as FX and corporate bonds, particularly among tech-savvy retail investors.

The proposal also responds to the surge in institutional engagement worldwide. The FSA cited data showing over 1,200 financial institutions, including US pension funds and Goldman Sachs, now hold US-listed spot Bitcoin ETFs.

Japanese regulators aim to support similar developments domestically, especially as global fund flows into crypto continue to expand.

SMBC, Ava Labs to explore stablecoins in Japan

In April, Sumitomo Mitsui Financial Group (SMBC), TIS Inc, Ava Labs, and Fireblocks signed a Memorandum of Understanding to explore the commercialization of stablecoins in Japan. The collaboration will focus on issuing stablecoins pegged to both the US dollar and Japanese yen.

The group also plans to examine the use of stablecoins for settling tokenized real-world assets such as stocks, bonds and real estate.

In March, Japan also issued its first license allowing a company to deal with stablecoins to SBI VC Trade, a subsidiary of the local financial conglomerate SBI, which said it was preparing to support Circle’s USDC (USDC).

Tin tức mới nhất

BitouChnews

2025-07-10 04:01:32

BitouChnews

2025-07-10 04:00:25

BitouChnews

2025-07-08 11:56:06